India: The Gujarati state government has approved the development of a new shipbuilding cluster to be located in the south of the state at Dahej.

[Read More]

Source: Baird Maritime

Dutch Freighter Arklow Resolve aground near Vordingborg

A Dutch coaster has gone aground at Vordingborg. Navy Operational Command has sent an environmental ship out to damming possible contamination.

This morning is a Dutch coaster aground off Vordingborg. Navy Operational Command, Fleet, arrived on the spot.

[Read More]

Source: Sea News Turkey

This morning is a Dutch coaster aground off Vordingborg. Navy Operational Command, Fleet, arrived on the spot.

[Read More]

Source: Sea News Turkey

"Sagasbank" ran aground in the Kolding Fjord

On Mar 27, 2011, at 10.18 p.m. the "Sagasbank" ran aground in the Kolding Fjord en route to Kolding. The grounding occurred with a speed of eight knots. No injuries, no oil spills reported. The patrol vessel "Rota" was sent to the grounding site, but was replaced by the anti pollution vessel "Marie Miljø" in the morning of Mar 28. In the afternoon divers surveyed the ship's bottom. The ship was refloated on Mar 29 and berthed in the port of Kolding to unload its cargo.

Source: Sea News Turkey

New NK office opened in Shenzhen, China.

ClassNK established a new office in Shenzhen, China on 1st April 2011 at the following address.

ClassNK established a new office in Shenzhen, China on 1st April 2011 at the following address.Address: Room No.10, 2F, Tower B, Cyber Building, No.1079, Nanhai Road, Shekou, Nanshan District, Shenzhen, P.R. China 518067

Tel: +86-755-26860732

Fax: +86-755-22714806

E-mail: zh@classnk.or.jp

Note: Application for surveys and contact to be made to ClassNK Guangzhou Office.

-ClassNK Guangzhou Office-

Tel.:+86-20-38770693, -38770687

Fax.:+86-20-38770716

E-mail: zg@classnk.or.jp

Shippers face radiation spot checks

Some shipping companies, already facing burdensome fuel costs, say they now must contend with radiation spot checks on ships that have visited Japan.

Some shipping companies, already facing burdensome fuel costs, say they now must contend with radiation spot checks on ships that have visited Japan.[Read More]

Source: UPI

India: Governmentt looks at checking shipping cartelisation

The government plans to put in place a mechanism for regulating the restrictive trade practices in the shipping sector, especially the ones which impact containerised trade. The enabling provision for the mechanism would be part of the proposed Shipping Trade Practices Act.

The government plans to put in place a mechanism for regulating the restrictive trade practices in the shipping sector, especially the ones which impact containerised trade. The enabling provision for the mechanism would be part of the proposed Shipping Trade Practices Act.[Read More]

Source: Business Standard

World’s Biggest Shipping Lines Say They're Still Serving Tokyo Bay Ports

The world’s biggest oil-tanker firms, dry bulk carriers and container lines are servicing Japanese ports, judging there to be no threat to vessels or crew from radiation leaking from a crippled nuclear plant.

[Read More]

Source: Bloomberg

[Read More]

Source: Bloomberg

Danaos Corporation Announces Completion of Comprehensive Financing Plan

Athens, Greece - March 31, 2011. Danaos Corporation (NYSE: DAC), a leading international owner of containerships, today announced the formal completion of its previously announced Comprehensive Financing Plan, which fully funds Danaos’s current newbuilding program, comprised of 13 additional containerships aggregating 129,250 TEUs with scheduled deliveries up to mid 2012. The Plan provides for new financing of $818 million including $203 million from an Export-Import Bank of China led consortium, $190 million of vendor finance and $425 million from a consortium comprising of 14 of its existing bank lenders. Repayment schedules, interest rate margin and covenants have been reset and harmonized with this new structure and provide a competitive and solid financing package until end of 2018.

Athens, Greece - March 31, 2011. Danaos Corporation (NYSE: DAC), a leading international owner of containerships, today announced the formal completion of its previously announced Comprehensive Financing Plan, which fully funds Danaos’s current newbuilding program, comprised of 13 additional containerships aggregating 129,250 TEUs with scheduled deliveries up to mid 2012. The Plan provides for new financing of $818 million including $203 million from an Export-Import Bank of China led consortium, $190 million of vendor finance and $425 million from a consortium comprising of 14 of its existing bank lenders. Repayment schedules, interest rate margin and covenants have been reset and harmonized with this new structure and provide a competitive and solid financing package until end of 2018.As a result of the completion of these financing arrangements, the exercise price of the 15 million warrants the Company has agreed to issue to its lenders, of which 11.2 million were issued on March 17, 2011, has increased from $6.00 per share to $7.00 per share.

Danaos’ CEO, Dr. John Coustas, stated:

After a long period of negotiations Danaos is now back on track to continue with its growth strategy. What made this outcome possible was the commitment of the management and the faith that our lenders and partners have shown on us. On another hand the strength of the container market combined with strong fundamentals further solidify our position.

Now that we can leave all that behind we will continue to serve our customers in the best possible way and continue to provide them with first class service which is the cornerstone of our success.

At the same time our strategy will center on delivering superior returns to our shareholders and grow accretively for their benefit.

I would like finally to thank Evercore Partners for their valuable advice throughout this process.

About Danaos Corporation

Danaos Corporation is an international owner of containerships, chartering its vessels to many of the world's largest liner companies. Danaos’ current fleet of 52 containerships aggregating 233,429 TEUs ranks Danaos among the largest containership charter owners in the world based on total TEU capacity. Danaos is one of the largest U.S.-listed containership companies based on fleet size. Furthermore, Danaos has a contracted fleet of 13 additional containerships aggregating 129,250 TEU with scheduled deliveries up to the second quarter of 2012. The Danaos's shares trade on the New York Stock Exchange under the symbol "DAC".

Source: Danos

Dry bulk market weakens on slower demand, hopes for mid-term rebound on Japan’s reconstruction

The dry bulk market, as reflected in the Baltic Dry Index (BDI) retreated for a third day yesterday, after staying flat on Monday, to end at 1,530 points, down by 0.97 percent. The main losing segment was the Panamax one with falls of 2.28 percent,while the Capesize market was on the upside, gaining 0.68 percent. As it turns out, for the time being, the disaster in Japan and especially the danger of radiation has hit trade activity, limiting cargoes to and from Japan. The country is a strong importer of dry bulk commodities, such as coal and iron ore.

The dry bulk market, as reflected in the Baltic Dry Index (BDI) retreated for a third day yesterday, after staying flat on Monday, to end at 1,530 points, down by 0.97 percent. The main losing segment was the Panamax one with falls of 2.28 percent,while the Capesize market was on the upside, gaining 0.68 percent. As it turns out, for the time being, the disaster in Japan and especially the danger of radiation has hit trade activity, limiting cargoes to and from Japan. The country is a strong importer of dry bulk commodities, such as coal and iron ore.[Read More]

Source: Hellenic Shipping News

Japan Reconstruction May Boost Dry-Bulk Shipping Cargos, Ease Overcapacity

Reconstruction in Japan following a tsunami and earthquake that destroyed or damaged more than 150,000 buildings may boost volumes for dry-bulk shipping lines struggling with global overcapacity.

Reconstruction in Japan following a tsunami and earthquake that destroyed or damaged more than 150,000 buildings may boost volumes for dry-bulk shipping lines struggling with global overcapacity.[Read More]

Source: Bloomberg

Petrofac Awarded Shell Contract in Iraq

Petrofac, the international oil & gas facilities service provider, can confirm it has been awarded a contract, in excess of US$240 million by Shell Iraq Petroleum Development B.V. for developments in the Majnoon Field, Southern Iraq.

Petrofac, the international oil & gas facilities service provider, can confirm it has been awarded a contract, in excess of US$240 million by Shell Iraq Petroleum Development B.V. for developments in the Majnoon Field, Southern Iraq.Under the competitively tendered contract, Petrofac is providing engineering, procurement, fabrication and construction management services for the development of a new early production system comprising two trains each with capacity for 50,000 barrels of oil per day, along with upgrading of existing brownfield facilities. Work on the project began in mid-2010 and is expected to complete during the fourth quarter of 2012.

Ayman Asfari, Petrofac group chief executive, said: “Majnoon is one of Iraq’s largest developments and we are delighted to be working with Shell to assist them with unlocking the field’s potential. Iraq’s geographic location, adjacent to many of our existing areas of operation, made it a natural market for the group as we continue to broaden our geographic footprint.”

Subramanian Sarma, managing director, Petrofac Engineering & Construction adds: “Prior to beginning work with Shell in Iraq last year, we had spent many months preparing in order to achieve a sufficient level of readiness across several aspects of our business operations. All of our activities are underpinned by our strong commitment to safety, quality and integrity and alongside Shell and the local community, we are working to deliver this project to the standards our customers and stakeholders expect from us.”

Source: Perofac

Oleg Strashnov delivered to Seaway

Today, Thursday March 31st 2011, Seaway Heavy Lifting took delivery of their new build DP3 crane vessel Oleg Strashnov. During the last two weeks, the sea trials and test lifts were successfully completed. DNV witnessed the 5,500 mt overload test. Earlier this month the 800 mt auxiliary hook and 200 mt whiphoist were already successfully tested. The vessel has a sailing speed of 14 knots.

The Oleg Strashnov is scheduled to start its first project, the installation of the Sheringham Shoal Windfarm mono pile foundation structures, transition pieces and substation decks, in April 2011. Moreover she is then scheduled to install the Clipper deck later this Summer.

Source: Seaway Heavy Lifting

The Oleg Strashnov is scheduled to start its first project, the installation of the Sheringham Shoal Windfarm mono pile foundation structures, transition pieces and substation decks, in April 2011. Moreover she is then scheduled to install the Clipper deck later this Summer.

Source: Seaway Heavy Lifting

Drillsearch: PEL 91 Drilling Program Set to Commence

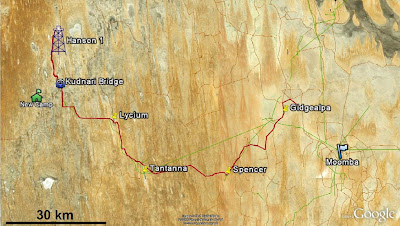

Drillsearch Energy Limited (ASX: DLS) is pleased to announce that the PEL 91 Joint Venture (Beach Energy 40% and operator / Drillsearch 60%) is mobilising the Ensign #18 drilling rig to the Hanson-1 drilling location. The rig is expected to arrive by the end of the week. The rig will be transported into the Western Flank area via the Kudnari Bridge over the Cooper Creek and into PEL 91. (See map below).

Once the rig reaches the Hanson-1 drilling location, Beach and Ensign will conduct a detailed predrilling safety inspection and effect minor repairs on the rig. The inspection and repairs are expected to take 7 -10 days. Commencement of drilling is expected to start in the second week of April.

The first prospect to be drilled in the five well PEL 91 drilling campaign is the Hanson Prospect.

Once the Ensign #18 drilling rig is on location and the Hanson-1 well has been spudded Drillsearch will provide a further update.

Mr Brad Lingo, Managing Director noted that “This marks the start of a very exciting time for Drillsearch. After a long period of anticipation we now have possession of the rig and spudding of these highly prospective wells is imminent”.

Source: Drillsearch

Once the rig reaches the Hanson-1 drilling location, Beach and Ensign will conduct a detailed predrilling safety inspection and effect minor repairs on the rig. The inspection and repairs are expected to take 7 -10 days. Commencement of drilling is expected to start in the second week of April.

The first prospect to be drilled in the five well PEL 91 drilling campaign is the Hanson Prospect.

Once the Ensign #18 drilling rig is on location and the Hanson-1 well has been spudded Drillsearch will provide a further update.

Mr Brad Lingo, Managing Director noted that “This marks the start of a very exciting time for Drillsearch. After a long period of anticipation we now have possession of the rig and spudding of these highly prospective wells is imminent”.

Source: Drillsearch

Dutch arbitrators rule for Fairmount

The Netherlands Arbitration Institute (NAI) has ruled in favour of offshore contractor Fairmount Marine in a contract dispute with heavy transport company Fairstar.

The arbitration board rejected Fairstar’s 2008 claim that Fairmount Marine was responsible for cost overruns and delays in the conversion and delivery of two semi-submersible heavy transport vessels, Fjord and Fjell, at Malta Shipyards.

[Read More]

Source: upstream

The arbitration board rejected Fairstar’s 2008 claim that Fairmount Marine was responsible for cost overruns and delays in the conversion and delivery of two semi-submersible heavy transport vessels, Fjord and Fjell, at Malta Shipyards.

[Read More]

Source: upstream

CALL TO ARMS AGAINST LEAKS AND WELL INCIDENTS

The Petroleum Safety Authority Norway (PSA) has asked the industry to propose specific measures for reducing the number of hydrocarbon leaks and well control incidents on the Norwegian continental shelf.

A very positive trend in the number of hydrocarbon leaks larger than 0.1 kilograms per second was experienced off Norway from 2002 to 2007.

The industry’s goal of reducing the number of leaks of this type to a maximum of 10 per year by 2008 was achieved as early as 2007.

Over the past three years, however, this positive development has unfortunately ceased. The figure rose to 14 in 2008 and 15 in 2009, before returning to 14 last year.

The same trend applies to well control incidents, where a steady improvement over many years has again ceased. Such events on the NCS totalled 11 in 2008 and had reached 28 by 2010.

This development emerges from the collation of figures for last year in PSA’s latest process on trends in risk level in the petroleum activity (RNNP).

The overview was presented and discussed in a meeting at the PSA on 30 March with representatives of the operational management at the oil companies and the Norwegian Oil Industry Association (OLF).

“This position is challenging,” says Magne Ognedal, director-general of the PSA. “It’s therefore very important that the industry succeeds in reversing the negative trend.”

He is satisfied that the industry representatives signalled at the meeting that they will now draw up proposals for specific measures to bring developments back on a positive track.

These are to be submitted to the PSA on 27 April, the day when the overall results from the RNNP process for 2010 are due to be presented.

Source: Ptil

A very positive trend in the number of hydrocarbon leaks larger than 0.1 kilograms per second was experienced off Norway from 2002 to 2007.

The industry’s goal of reducing the number of leaks of this type to a maximum of 10 per year by 2008 was achieved as early as 2007.

Over the past three years, however, this positive development has unfortunately ceased. The figure rose to 14 in 2008 and 15 in 2009, before returning to 14 last year.

The same trend applies to well control incidents, where a steady improvement over many years has again ceased. Such events on the NCS totalled 11 in 2008 and had reached 28 by 2010.

This development emerges from the collation of figures for last year in PSA’s latest process on trends in risk level in the petroleum activity (RNNP).

The overview was presented and discussed in a meeting at the PSA on 30 March with representatives of the operational management at the oil companies and the Norwegian Oil Industry Association (OLF).

“This position is challenging,” says Magne Ognedal, director-general of the PSA. “It’s therefore very important that the industry succeeds in reversing the negative trend.”

He is satisfied that the industry representatives signalled at the meeting that they will now draw up proposals for specific measures to bring developments back on a positive track.

These are to be submitted to the PSA on 27 April, the day when the overall results from the RNNP process for 2010 are due to be presented.

Source: Ptil

BP extends maintenance and modifications contract with Aker Solutions

BP has decided to extend the maintenance and modification contract with Aker Solutions, exercising a one year option in the existing agreement for the Ula, Valhall, Hod and Tambar fields. Work under the new option will last until April 2012. The contract value is estimated to be NOK 2-300 MNOK.

BP has decided to extend the maintenance and modification contract with Aker Solutions, exercising a one year option in the existing agreement for the Ula, Valhall, Hod and Tambar fields. Work under the new option will last until April 2012. The contract value is estimated to be NOK 2-300 MNOK.The original maintenance and modification contract was signed in 2005.

"We are very pleased that BP again demonstrates their trust in Aker Solutions. We look forward to continue our long term cooperation with BP", says executive vice president for Maintenance, Modifications and Operations in Aker Solutions, Tore Sjursen.

Scope of work under the contract includes engineering, procurement, fabrication, installation and maintenance support services and currently employs approximately 280 people in Stavanger, 50 in Egersund and 1000 in offshore rotation. The contract also includes hook-up and completion of the new PH platform at Valhall and tie-in of Oselvar to the Ula field.

Source: Aker Solutions

Carpenters union pickets near Woodbury Common

by Christian Livermore - Times Herald Record

A small group of protesters picketed Tuesday outside the entrance of Woodbury Common Premium Outlets.

The workers were protesting what officials at the Empire State Regional Council of Carpenters say is the failure of several stores within the Common to pay the prevailing wage for carpenters working on renovations and other projects being done in their stores.

The stores are paying 40 to 50 percent below the prevailing wage, which should be about $53 an hour including health benefits, said Daniel Souza, the union's Southeast Region Team Leader for Westchester County.

A Woodbury Common spokeswoman did not respond to a request for comment.

A small group of protesters picketed Tuesday outside the entrance of Woodbury Common Premium Outlets.

The workers were protesting what officials at the Empire State Regional Council of Carpenters say is the failure of several stores within the Common to pay the prevailing wage for carpenters working on renovations and other projects being done in their stores.

The stores are paying 40 to 50 percent below the prevailing wage, which should be about $53 an hour including health benefits, said Daniel Souza, the union's Southeast Region Team Leader for Westchester County.

A Woodbury Common spokeswoman did not respond to a request for comment.

Izod and Loft outlets coming to Tanger Oultet in Tilton

By Matthew Spolar - The Concord Monitor

Izod and Loft stores are coming to the Tanger Outlet Center in Tilton.

Both stores will open in the first week of April. Tanger is located left from Exit 20 off Interstate 93 in Tilton.

Eric Proulx, general manager of the outlet center, said in a statement that he is delighted by the arrival of both stores.

Izod "offers dressy-casual and sportswear apparel that mimics our everyday shoppers," Proulx said. As for the Loft outlet store, "it's exciting to give our Tanger customers the opportunity to save on fashions and accessories from one of the world's most popular brands."

Izod and Loft stores are coming to the Tanger Outlet Center in Tilton.

Both stores will open in the first week of April. Tanger is located left from Exit 20 off Interstate 93 in Tilton.

Eric Proulx, general manager of the outlet center, said in a statement that he is delighted by the arrival of both stores.

Izod "offers dressy-casual and sportswear apparel that mimics our everyday shoppers," Proulx said. As for the Loft outlet store, "it's exciting to give our Tanger customers the opportunity to save on fashions and accessories from one of the world's most popular brands."

Outlet center planned for Woodstock

Atlanta Business Chronicle - by Lisa R. Schoolcraft

Atlanta Business Chronicle Horizon Group Properties Inc., out of Rosemont, Ill., has filed plans with the state Department of Community Affairs for a 435,000 square foot shopping center for factory outlet stores in Woodstock.

The development, called The Outlet Shoppes at Atlanta, will be located at 728 Woodstock Parkway in Woodstock, and would include six outparcels, according to filings with the state.

The project is expected to be complete by May 2013.

Atlanta Business Chronicle Horizon Group Properties Inc., out of Rosemont, Ill., has filed plans with the state Department of Community Affairs for a 435,000 square foot shopping center for factory outlet stores in Woodstock.

The development, called The Outlet Shoppes at Atlanta, will be located at 728 Woodstock Parkway in Woodstock, and would include six outparcels, according to filings with the state.

The project is expected to be complete by May 2013.

First Chinese orders received for Unitor Ballast Water Treatment Systems

Wilhelmsen Technical Solutions has received orders for five Unitor Ballast Water Treatment Systems (Unitor BWTS) from Chinese yards.

Wilhelmsen Technical Solutions has received orders for five Unitor Ballast Water Treatment Systems (Unitor BWTS) from Chinese yards.Three systems are to be installed on general purpose cargo vessels built at Baibuting Shipbuilding Co. Shandong. The remaining two systems are to be installed on asphalt carriers built at Nanjing East Start Shipbuilding Co.

The cargo vessels being built at Baibuting Shipbuilding Co. Shandong are for Shipowner Bluarrow Shipping SA with technical consultant La Prora Ship Management. The vessels require ballast water systems with a capacity of 350m3/h each. The vessel deliveries are due in Q2 and Q4 in 2011. The asphalt carriers built at Nanjing East Start Shipbuilding Co are for the Singapore based ship owner Stolt Bitumen Services, a new division of the Stolt Nielsen Group. Each system has a capacity of 200m3/h and the vessels will be delivered in Q4 2011 and Q1 2012.

With an increasing number of Type Approved ballast water treatment systems in the market, the competition for securing new contracts is tough. “We have developed a system that benefits both the installers and operators”, says Petter Traaholt, President in Wilhelmsen Technical Solutions. “A small footprint and flexible installation options are valued by the yards. Feedback from owners suggest that treatment on ballasting only, low power consumption and easy operation are seen as key factors when selecting a ballast water treatment system”, he continues.

Wilhelmsen Technical Solutions is part of a global network with the capability to serve customers in 2200 ports and 125 countries, providing worldwide support and peace of mind. “This is the first ballast water treatment system we have ordered. With little service experience with any system, we wanted to choose a supplier that has excellent worldwide support and the backup of a large organisation”, says a representative at Stolt Bitumen Services.

The Unitor BWTS is applicable to all vessel types and sizes. To date, Wilhelmsen Technical Solutions has won contracts to install the system on a range of vessel types including PCTC, LNG carrier, passenger ferry, bulker, general cargo carrier, and asphalt carrier.

The Unitor BWTS technology is provided by the South African company Resource Ballast Technology (RBT). The system is produced, marketed and sold globally by Wilhelmsen Technical Solutions. With the support of the global network, Unitor BWTS is a safe choice for the lifetime of the system.

Source: Wilhelmsen Technical Solutions

Northrop Grumman Completes Spin-Off of Huntington Ingalls Industries, Inc.

Northrop Grumman Corporation (NYSE:NOC) today announced that it has completed the previously announced spin-off of its subsidiary Huntington Ingalls Industries, Inc. (NYSE:HII). Northrop Grumman stockholders of record at the close of business of the New York Stock Exchange (NYSE) on March 30, 2011, received one share of HII common stock for every six shares of Northrop Grumman common stock held. Stockholders will receive cash in lieu of fractional shares of HII. As a result of the spin-off, Northrop Grumman will report Shipbuilding financial results as discontinued operations for the 2011 first quarter and all prior periods.

"Today's completion of the separation of Huntington Ingalls from Northrop Grumman is an important milestone benefitting both companies. We thank HII for their many contributions to our company and the defense of our nation, and wish them the best as an independent company," said Wes Bush, Northrop Grumman chief executive officer and president.

"Northrop Grumman will now be focused on its core markets of aerospace systems, electronic systems, information systems and technical services. Our portfolio has tremendous capability, technology and synergy across these areas, and we are fully dedicated to delivering innovative and mission-critical systems and products. Going forward, we will create value for shareholders, customers and employees through a more focused portfolio and continued performance improvement," Bush concluded.

The distribution of HII shares will be made in book entry form and no action or payment by Northrop Grumman stockholders of record is required to receive HII shares. No physical share certificates of HII will be issued. An information statement containing details of the spin-off and important information about HII was mailed to Northrop Grumman stockholders on March 21, 2011.

The HII spin-off has been structured to qualify as a tax-free distribution to Northrop Grumman stockholders for U.S. Federal tax purposes, except for the cash received in lieu of fractional shares. Northrop Grumman stockholders should consult their tax advisors with respect to U.S. federal, state, local and foreign tax consequences of the HII spin-off.

Credit Suisse served as lead financial advisor and joint lead financing arranger. Perella Weinberg Partners served as financial advisor. JPMorgan Chase served as joint lead financing arranger. Gibson, Dunn & Crutcher served as legal advisor.

Northrop Grumman is a leading global security company whose 75,000 employees provide innovative systems, products and solutions in aerospace, electronics, information systems, and technical services to government and commercial customers worldwide. Please visit www.northropgrumman.com for more information.

Statements in this release, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward‑looking statements due to factors such as: the effect of economic conditions in the United States and globally; access to capital; future sales and cash flows; changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, changes in import and export policies, and changes in customer short-range and long-range plans); and other risk factors disclosed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. Any such risks or uncertainties could cause our results to differ materially from those expressed in forward-looking statements.

Source: Northrop Grumman

"Today's completion of the separation of Huntington Ingalls from Northrop Grumman is an important milestone benefitting both companies. We thank HII for their many contributions to our company and the defense of our nation, and wish them the best as an independent company," said Wes Bush, Northrop Grumman chief executive officer and president.

"Northrop Grumman will now be focused on its core markets of aerospace systems, electronic systems, information systems and technical services. Our portfolio has tremendous capability, technology and synergy across these areas, and we are fully dedicated to delivering innovative and mission-critical systems and products. Going forward, we will create value for shareholders, customers and employees through a more focused portfolio and continued performance improvement," Bush concluded.

The distribution of HII shares will be made in book entry form and no action or payment by Northrop Grumman stockholders of record is required to receive HII shares. No physical share certificates of HII will be issued. An information statement containing details of the spin-off and important information about HII was mailed to Northrop Grumman stockholders on March 21, 2011.

The HII spin-off has been structured to qualify as a tax-free distribution to Northrop Grumman stockholders for U.S. Federal tax purposes, except for the cash received in lieu of fractional shares. Northrop Grumman stockholders should consult their tax advisors with respect to U.S. federal, state, local and foreign tax consequences of the HII spin-off.

Credit Suisse served as lead financial advisor and joint lead financing arranger. Perella Weinberg Partners served as financial advisor. JPMorgan Chase served as joint lead financing arranger. Gibson, Dunn & Crutcher served as legal advisor.

Northrop Grumman is a leading global security company whose 75,000 employees provide innovative systems, products and solutions in aerospace, electronics, information systems, and technical services to government and commercial customers worldwide. Please visit www.northropgrumman.com for more information.

Statements in this release, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward‑looking statements due to factors such as: the effect of economic conditions in the United States and globally; access to capital; future sales and cash flows; changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, changes in import and export policies, and changes in customer short-range and long-range plans); and other risk factors disclosed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. Any such risks or uncertainties could cause our results to differ materially from those expressed in forward-looking statements.

Source: Northrop Grumman

SUBSEA 7 ANNOUNCES CONTRACT FOR E.ON IN NORTH SEA

Subsea 7, a global leader in seabed-to-surface engineering, construction and services, today announces the award of an engineering and installation contract by E.ON Ruhrgas UK E&P for the Huntington Development in the North Sea.

Subsea 7, a global leader in seabed-to-surface engineering, construction and services, today announces the award of an engineering and installation contract by E.ON Ruhrgas UK E&P for the Huntington Development in the North Sea.The Subsea 7 workscope comprises the installation of 12km of the 8-inch Gas Export pipeline, installation of infield flexible flowlines, main static umbilical and associated risers as well as installation of subsea structures followed by tie-ins, pre-commissioning and system testing.

Engineering work has commenced in the Aberdeen office with installation using several of Subsea 7’s fleet occurring through to 2012.

Steph McNeill, Subsea 7’s Vice President – UK stated: “I’m delighted that E.ON Ruhrgas UK E&P has chosen Subsea 7 to work on its prestigious Huntington development. We have safely nd successfully delivered numerous North Sea projects whilst maximising efficiencies through security of supply and early engagement in the planning and design process. We look forward to similar success with the Huntington Development over the coming year.”

The Huntington Development is located 140 nautical miles North East of Aberdeen in Block 22/14 in the Central North Sea with water depths of 90m. E.ON Ruhrgas UK E&P is the operator and has a 25 % interest.

Source: Subsea 7

Helix Well Containment Group to Significantly Expand Deepwater Capabilities

The Helix Well Containment Group (HWCG) announced today it will substantially increase its subsea well containment capabilities this year by expanding its ability to control and contain a release in water depths up to 10,000 feet.

The Helix Well Containment Group (HWCG) announced today it will substantially increase its subsea well containment capabilities this year by expanding its ability to control and contain a release in water depths up to 10,000 feet.HWCG is a consortium of 22 deepwater operators in the Gulf of Mexico that has come together with the common goal of expanding capabilities to quickly and comprehensively respond to such an incident to protect employees, communities and the environment. HWCG’s current system is capable of facilitating control and containment of spills in water depths up to 5,600 feet and will utilize Helix Energy Solutions Group’s Q4000, the intervention vessel effectively used during the Deepwater Horizon response. The system features a 10,000 psig capping stack.

By April 8, 2011, the system is expected to have increased containment capacity and capabilities for water depths up to 8,000 feet, as well as capture and processing capabilities of 55,000 barrels of oil per day and 95 million cubic feet of natural gas per day. In the coming weeks, HWCG will also add a 15,000 psig capping stack.

Full operational capability for water depths of up to 10,000 feet is anticipated mid-summer 2011.

“Our enhanced response and containment capabilities would exceed the depth of any well currently drilled or planned by the consortium’s 22 members and would allow operators to control capping and containment stacks at the greater depths,” said Roger Scheuermann, commercial director for HWCG.

Building upon equipment effectively used in the Deepwater Horizon response, HWCG has signed an agreement with Helix Energy Solutions Group (NYSE: HLX) to provide the primary components of the response. Additionally, HWCG has agreements in place with more than 30 service providers who will provide additional services, products and personnel, if needed.

Source: EON

TGS Commences Extensive 2D Reprocessing Project in Northern Makassar Strait, Indonesia

PERTH, AUSTRALIA (31 March 2011) – TGS has commenced an extensive multi-phase reprocessing program of 2D seismic data located in the Makassar Strait, Indonesia. The first phase consists of 2,700 km of seismic data in the Northern Mahakam Delta.

The original and reprocessed data support the exploration potential of the deepwater area of the Mahakam Delta. Interpretation of the seismic data since 2001 has demonstrated potential hydrocarbon prospectivity in the basin, resulting in the award of exploration acreage and the drilling of several exploration wells. Partial relinquishments of the exploration blocks have also recently created opportunities for new exploration in the area.

The data will be reprocessed with customized techniques to enhance imaging of the main structures and reservoir targets in the basin. The reprocessed data is intended to enhance definition of Direct Hydrocarbon Indicators (DHIs) and Amplitude Versus Offset (AVO) anomalies associated with turbidite reservoirs seen on the original 2D seismic data.

Data from this initial phase of reprocessing will be available for clients in Q3 2011. This project is supported by industry funding.

TGS-NOPEC Geophysical Company (TGS) provides global geoscience data products and services to the oil and gas industry for the exploration and delineation of hydrocarbon reserves. We design and acquire multi-client data projects worldwide that make up our data library of seismic, gravity/magnetic and well data, enhanced by our seismic imaging technology and regional interpretation expertise.

All statements in this press release other than statements of historical fact are forward-looking statements, which are subject to a number of risks, uncertainties and assumptions that are difficult to predict, and are based upon assumptions as to future events that may not prove accurate. These factors include TGS' reliance on a cyclical industry and principal customers, TGS' ability to continue to expand markets for licensing of data, and TGS' ability to acquire and process data product at costs commensurate with profitability. Actual results may differ materially from those expected or projected in the forward-looking statements. TGS undertakes no responsibility or obligation to update or alter forward-looking statements for any reason.

Source: TGS

TransAtlantic signs contract for AHT/Icebreaker Balder Viking

TransAtlantic has signed a contract with the English company Capricorn Energy Ltd, for the AHTS/Icebreaker Balder Viking. Capricorn is a wholly owned subsidiary of the British oil company Cairn Energy UK PLC based in Edinburgh.

The AHTS/Icebreaker Balder Viking will assist oil drilling west of Greenland, starting in end of April 2011. The operation extends over a four month period.

The assignment is for "supply services" for the drilling operation and will probably also include towing of but not icebreaking as the operation will take place in open water.

Source: TransAtlantic

The AHTS/Icebreaker Balder Viking will assist oil drilling west of Greenland, starting in end of April 2011. The operation extends over a four month period.

The assignment is for "supply services" for the drilling operation and will probably also include towing of but not icebreaking as the operation will take place in open water.

Source: TransAtlantic

Statoil: Further maturing the new rig concept

Statoil has had an ongoing tender process for the new category B rig type – a semi-submersible designed and equipped for subsea well intervention. The rig will be a highly anticipated contribution to the rig fleet on the Norwegian continental shelf (NCS).

Jon Arnt Jacobsen, Statoil’s chief procurement officer

“The decision to allow more time to mature category B is motivated by input from the bidders. We see that an integration of additional services, combined with more time for an in-depth FEED phase, can improve the robustness of the concept,” says Statoil’s chief procurement officer, Jon Arnt Jacobsen.

“In reality, this is to be regarded as an extension of the bidding process where we according to plan will be able to award the final contract within 2011. Expected delivery from the yard should take place in 2014,” Jacobsen adds.

The design of the category B service unit is based on the bidders own FEEDs. The rig is designed for year-round well intervention operations for Statoil, providing a full range of heavy well intervention and light drilling techniques – including through-tubing rotary drilling (TTRD), wireline, coil tubing, high pressure pumping and cementing. Statoil is asking for a minimum of one rig of this type for work on the NCS.

Knut Gjertsen, responsible for Operations North field development.

“Traditional drilling rigs are not efficient enough for well intervention purposes, so Statoil has developed a new rig type for well intervention in collaboration with industry partners. This rig type will close the gap between light intervention vessels and conventional drilling units. The category B rig with its integrated service lines is expected to reduce well intervention operations costs by up to 40%,” Jacobsen says.

The key to maintaining the current production level on the NCS through 2020 is increased recovery from existing fields and fast and effective development of new fields. It is becoming more important to increase drilling activity in mature fields to attain the full potential of the NCS.

“Improved subsea well intervention methods are making vital contributions to increased recovery. Increased recovery is one of the most important contributions to keep up current production level at the Norwegian continental shelf," says Knut Gjertsen, responsible for Operations North field development.

Source: Statoil

NOCC: NEWBUILDING CONTRACT FOR A 6,500 CEU CAR CARRIER

Norwegian Car Carriers ASA has entered into a shipbuilding contract with Hyundai Heavy Industries Co., Ltd. ('HHI') for the construction of a large car carrier with a capacity of about 6,500 CEU for delivery in August 2012. The project price including costs related to the purchase, financing and supervision of the construction of the vessel is about NOK 385 million, which will be financed by a bank facility of USD 46.2 million and by available liquid funds.

The contract includes an option for an identical vessel at the same contract price. This option must be declared within 30 June 2011.

HHI is one of the most experienced builders of large car carriers with a recognized modern design and high construction quality. The state of the art design of the vessel with a 150 ton ramp capacity and 4 hoistable cargo decks allows for efficient transport of cars, commercial vehicles and "high and heavy" cargo. The vessel will be among the most fuel efficient large car carriers, and her engines will meet all currently known future emission requirements.

"NOCC is pleased to have concluded a contract for delivery of a high quality car carrier at an attractive price and with an early delivery date. The car carrier market is expected to strengthen considerably over the next few years, and this investment is expected to contribute positively to NOCC's net profit as from delivery, " CEO Lars Solbakken said in a comment.

Source: nocc

The contract includes an option for an identical vessel at the same contract price. This option must be declared within 30 June 2011.

HHI is one of the most experienced builders of large car carriers with a recognized modern design and high construction quality. The state of the art design of the vessel with a 150 ton ramp capacity and 4 hoistable cargo decks allows for efficient transport of cars, commercial vehicles and "high and heavy" cargo. The vessel will be among the most fuel efficient large car carriers, and her engines will meet all currently known future emission requirements.

"NOCC is pleased to have concluded a contract for delivery of a high quality car carrier at an attractive price and with an early delivery date. The car carrier market is expected to strengthen considerably over the next few years, and this investment is expected to contribute positively to NOCC's net profit as from delivery, " CEO Lars Solbakken said in a comment.

Source: nocc

Otto Marine secures US$43.4 million sales order for two 8,000bhp AHTS

Otto Marine Limited, a leading offshore marine company which specializes in building complex offshore support vessels, ship chartering and offers specialized offshore services, announce that its shipbuilding arm and wholly-owned subsidiary, Otto Offshore Limited has entered into a sales agreement to sell two 8,000 bhp AHTS to a third party at a market price of US$43.4 million (approximately S$54.8 million equivalent).

Otto Marine Limited, a leading offshore marine company which specializes in building complex offshore support vessels, ship chartering and offers specialized offshore services, announce that its shipbuilding arm and wholly-owned subsidiary, Otto Offshore Limited has entered into a sales agreement to sell two 8,000 bhp AHTS to a third party at a market price of US$43.4 million (approximately S$54.8 million equivalent).These two vessels are currently under construction and the Group expects it to be completed this year. Subsequent to the delivery of these two vessels, Redfish 3 Pte. Ltd., a unit of the Group will charter and deploy the vessels for 7 year.

“This is a good start to our new financial year 2011. Optimism in the offshore marine and oil and gas industry appears to be building up as a series of new rig orders were placed with major players recently. This could lead to an increase in the demand for support vessels. We have also witnessed recently a healthy increase in enquiries for new vessels. We are cautiously optimistic that this momentum will continue.” Mr Lee Kok Wah, President cum Group Chief Executive Officer

The above transaction will contribute positively to the profits of the Group for the financial year ending 31 December 2011. None of the Directors or substantial shareholders of Otto Marine has any interest, direct or indirect, in the aforesaid transaction save for their shareholdings in the Company.

Source: Otto Marine

STX OSV SECURES CONTRACT FOR A PLATFORM SUPPLY VESSEL

STX OSV Holdings Limited, one of the major global designers and shipbuilders of offshore and specialized vessels, announce that it has secured a new contract for the design and construction of a Platform Supply Vessel for an undisclosed customer.

The vessel will be of STX OSV’s own PSV 09 design, and is scheduled for delivery from STX OSV in Norway in 2012. The hull will be delivered from STX OSV in Romania.

Source: STX OSV

The vessel will be of STX OSV’s own PSV 09 design, and is scheduled for delivery from STX OSV in Norway in 2012. The hull will be delivered from STX OSV in Romania.

Source: STX OSV

Chinese Navy Sails to Another First Off Somalia

A Chinese warship has completed its first escort of a World Food Program shipment along the pirate-infested coast of Somalia in another milestone for the Chinese military as it tries to enhance its operational experience – and its international image.

A Chinese warship has completed its first escort of a World Food Program shipment along the pirate-infested coast of Somalia in another milestone for the Chinese military as it tries to enhance its operational experience – and its international image.[Read More]

Source: Market Watch

Asia-Europe Rates to drop below US$1,000 per TEU

Freight rates between Shanghai and North Europe have continued to fall 5.3 per cent to US$1,019 per TEU as of March 18 from $1,076 the previous week, and rates from Shanghai to Mediterranean ports decreased 3.9 per cent to $1,001 from $1,042, according to the China Containerised Freight Index (CCFI) report.

[Read More]

Source: Shippidedia

[Read More]

Source: Shippidedia

GE Energy to Acquire Converteam, Accelerating Momentum in High-Efficiency, Fully Electric Solutions

ATLANTA—March 29, 2011— GE (NYSE: GE) announced today that its Energy business has entered into an agreement to acquire approximately 90 percent of Converteam, a leading provider of electrification and automation equipment and systems, from a controlling shareholder group that includes management, Barclays Private Equity and LBO France, for approximately $3.2 billion. The transaction, endorsed by Converteam’s management team and employee representative groups, is expected to close during third quarter 2011, subject to customary closing conditions. Converteam’s senior management will retain approximately a 10 percent stake in the company. GE and Converteam senior management have entered into agreements pursuant to which GE would purchase the remaining shares in the company over the next two to five years. The price for the shares can vary based on the time of sale, business performance and other factors. GE expects that the price should be no greater than approximately $480 million.

ATLANTA—March 29, 2011— GE (NYSE: GE) announced today that its Energy business has entered into an agreement to acquire approximately 90 percent of Converteam, a leading provider of electrification and automation equipment and systems, from a controlling shareholder group that includes management, Barclays Private Equity and LBO France, for approximately $3.2 billion. The transaction, endorsed by Converteam’s management team and employee representative groups, is expected to close during third quarter 2011, subject to customary closing conditions. Converteam’s senior management will retain approximately a 10 percent stake in the company. GE and Converteam senior management have entered into agreements pursuant to which GE would purchase the remaining shares in the company over the next two to five years. The price for the shares can vary based on the time of sale, business performance and other factors. GE expects that the price should be no greater than approximately $480 million.Converteam’s solutions enable customers in a variety of industries to replace or improve mechanical processes with high-efficiency electric alternatives that deliver better reliability, less maintenance and lower emissions. Converteam’s portfolio includes drives and other power electronics, advanced rotating machines, generators and controls that when integrated address three critical customer needs across a range of industries:

Converting electricity into mechanical performance to power and control motion or industrial assets such as natural gas pipelines and gas gathering compressors;

Turning mechanical power into grid quality electricity in wind turbine, thermal power or hydro power installations;

Adjusting electrical frequency to precise user requirements, as in solar power inverters.

The multi-sector energy efficiency, electrification and automation industry, in which Converteam participates, was valued at over $30 billion in 2010 and is growing at rates above global GDP growth. Approximately 25 percent of the world’s electricity is used to power rotating machines in a wide range of industries and applications. Converteam’s high-efficiency solutions are designed to reduce the electricity consumption of rotating machines by nearly one-third, offering significant savings in terms of cost, energy intensity and greenhouse gas emissions. GE’s global reach and local expertise will improve Converteam’s ability to serve customers in high growth regions such as Brazil, Russia, China, India and the Middle East.

Building on more than 100 years of expertise in power electronics and automation technologies, Converteam operates across six key vertical sectors: offshore and onshore oil and gas, power generation, wind and solar renewables, industrial, marine and services. Headquartered in Massy, France, Converteam has 5,300 employees, including more than 1,600 engineers, and operates in more than 80 countries. Converteam recently announced 2010 sales of approximately $1.5 billion and EBITDA of approximately $239 million, with approximately 36 percent growth in orders versus 2009.

John Krenicki, GE vice chairman and president and CEO of GE Energy, said: “High-efficiency, fully electric solutions represent a megatrend across the global energy landscape. Our customers in key industries increasingly demand more reliable, efficient and flexible solutions in order to improve their competitiveness. Converteam’s world-class people and energy efficient products and services connect a lot of pieces in our portfolio which will enable us to offer integrated solutions to our customers.”

Pierre Bastid, president and CEO, Converteam, said: “GE and Converteam complement each other superbly. As a long-standing partner, GE fully understands our business model and will add significant value by allowing our technologists to work within GE’s tremendous network of researchers and engineers. In addition, we will expand our global footprint, extend our customer reach and be able to tap into a world-class supply chain. Within the GE family, Converteam now has the opportunity for further development and growth, benefitting our customers and employees alike.”

Source: GE Energy

Idle containership fleet shrinks ahead of new service launches

THE number of idle containerships in the worldwide fleet stands at 84 vessels with a total capacity of 185,000 TEU, including 23 carrier-controlled ships.

THE number of idle containerships in the worldwide fleet stands at 84 vessels with a total capacity of 185,000 TEU, including 23 carrier-controlled ships.[Read More]

Source: Sea News

Hamburg Süd: Port call of “Cap Isabel” in Tokyo cancelled at short notice

In all decisions concerning the current situation in Japan, Hamburg Süd is acting according to the maxim of, first and foremost, safeguarding the well-being of the seamen on the vessels it deploys and, at the same time, ensuring that Japan is not cut off from international commodity flows. Hamburg Süd is in close contact with various institutions, in particular the Federal Office for Radiation Protection. According to official measurements, radiation levels locally have been classified as giving no cause for concern. In addition, Hamburg Süd checks the weather situation prior to any port call in Tokyo.

“An appropriately large time window must be available to any vessel calling in Japan for it leave the region quickly if the situation in Fukushima should escalate further,” explains Eva Graumann, Director Corporate Communications for Hamburg Süd. This was the situation in the case of the port calls of the “Cap Jackson” in Yokohama and Tokyo respectively on 24 March. The current weather situation for the “Cap Isabel” is different. Since weather conditions in the next few days are expected to change, Hamburg Süd has decided at short notice to cancel the port call in Tokyo.

Hamburg Süd will continue to keep a close eye on the situation in Fukushima in order to be able to reach a timely decision on the next port calls in Tokyo and Yokohama.

Hamburg Süd has arranged for the appropriate measurements to be taken on the containers that have been deployed in Japan since the disaster in Fukushima.

Source: Hamburg Süd

“An appropriately large time window must be available to any vessel calling in Japan for it leave the region quickly if the situation in Fukushima should escalate further,” explains Eva Graumann, Director Corporate Communications for Hamburg Süd. This was the situation in the case of the port calls of the “Cap Jackson” in Yokohama and Tokyo respectively on 24 March. The current weather situation for the “Cap Isabel” is different. Since weather conditions in the next few days are expected to change, Hamburg Süd has decided at short notice to cancel the port call in Tokyo.

Hamburg Süd will continue to keep a close eye on the situation in Fukushima in order to be able to reach a timely decision on the next port calls in Tokyo and Yokohama.

Hamburg Süd has arranged for the appropriate measurements to be taken on the containers that have been deployed in Japan since the disaster in Fukushima.

Source: Hamburg Süd

Maersk deploys geared 4,500-TEU ship for west Africa string

MAERSK Line, the world's largest carrier, has announced it will deploy a 4,500-TEU newbuilding on the west Africa route at a naming ceremony at the Hyundai Heavy Industries shipyard in Ulsan, South Korea.

MAERSK Line, the world's largest carrier, has announced it will deploy a 4,500-TEU newbuilding on the west Africa route at a naming ceremony at the Hyundai Heavy Industries shipyard in Ulsan, South Korea.[Read More]

Source: Sea News

Taiwan: Shipbuilding market continues decline

Taiwan's shipbuilding market is still depressed despite recent economic growth and might not show a strong rebound until 2012, Taiwan's leading ship manufacturer said Wednesday.

Taiwan's shipbuilding market is still depressed despite recent economic growth and might not show a strong rebound until 2012, Taiwan's leading ship manufacturer said Wednesday.Industry prices which have fallen sharply since the economic recession took hold in 2008, have only recovered to 80 percent of pre-crisis levels, said Tang Tay-ping, chairman of the state-owned shipbuilder, CSBC Corp.

[Read More]

Source: Focus Taiwan

Shipowners need to change perception – LR

Lloyd’s Register says that looking for profit alone will not be enough in the future – ship owners and operators will need to concentrate on responsibilities to society as well as just making money.

[Read More]

Source: Motorship

[Read More]

Source: Motorship

China COSCO H2 net beats f'cast, faces choppy water

China COSCO Holdings Co Ltd, the country's top shipping conglomerate, reversed losses to post a slightly better than expected net profit in the second half of 2010.

China COSCO Holdings Co Ltd, the country's top shipping conglomerate, reversed losses to post a slightly better than expected net profit in the second half of 2010.But analysts say it is likely to face choppy waters ahead amid uncertain freight rates and rising costs.

[Read More]

Source: International Business Times

Japan Oil Ports Still Open to World’s Five Largest Tanker Lines

The world’s five biggest oil-tanker companies will still travel to the ports of Tokyo Bay, joining other shipping lines in judging them safe for crew and vessels.

The world’s five biggest oil-tanker companies will still travel to the ports of Tokyo Bay, joining other shipping lines in judging them safe for crew and vessels.Mitsui O.S.K. Lines Ltd., Frontline Ltd., Teekay Corp., Nippon Yusen Kaisha and NITC Co., whose ships can hold enough oil to supply Japan for 100 days, all said there is no disruption to their services. All vessels are avoiding a 30-mile exclusion zone around the crippled Fukushima Dai-Ichi nuclear plant, about 220 miles to the north of Tokyo.

[Read More]

Source: Businessweek

Noble considers older rig selling

* CEO will consider potential for spin-off of older rigs

* Rival Transocean also looking at spinning off older rigs

Noble Corp (NE.N), owner of the second-largest offshore drilling fleet, is looking at potential sales of older, less-capable rigs in order to improve the overall fleet profile, its chief executive said on Wednesday.

[Read More]

Source: Reuters

* Rival Transocean also looking at spinning off older rigs

Noble Corp (NE.N), owner of the second-largest offshore drilling fleet, is looking at potential sales of older, less-capable rigs in order to improve the overall fleet profile, its chief executive said on Wednesday.

[Read More]

Source: Reuters

Chevron expects Buckskin permit in a couple months

Chevron Corp (CVX.N) expects to get a permit for its Buckskin appraisal well in the Gulf of Mexico in a "couple months," having originally planned to drill last year, before the deepwater drilling moratorium.

Chevron Corp (CVX.N) expects to get a permit for its Buckskin appraisal well in the Gulf of Mexico in a "couple months," having originally planned to drill last year, before the deepwater drilling moratorium.[Read More]

Source: Reuters

Shell Wins Approval for Deep-Water Drilling Permit in Gulf

Royal Dutch Shell Plc won a U.S. permit to drill a deep-water well in the Gulf of Mexico where exploration was banned after the BP Plc blowout 11 months ago.

[Read More]

Source: Bloomberg

[Read More]

Source: Bloomberg

Brazil 'threatens' Asian floater sector

Brazil’s floating production sector could pose a threat to established Asian players in the coming years while the sector as a whole is poised for solid long-term growth, an offshore consultancy said in a new report.

Local content requirements in Brazil have led to a growing fabrication base for offshore drilling, production and support equipment in the country, Washington-based International Maritime Associates (IMA) said in a report on the sector.

[Read More]

Source: Upstream Online

Local content requirements in Brazil have led to a growing fabrication base for offshore drilling, production and support equipment in the country, Washington-based International Maritime Associates (IMA) said in a report on the sector.

[Read More]

Source: Upstream Online

Singapore: Sembcorp, Teekay Ink Long Term Fleet Maintenance Agreement

Sembawang Shipyard, a wholly-owned subsidiary of Sembcorp Marine has signed a long-term alliance contract with Teekay Marine Services, Canada, to provide ship-repair, refurbishment, upgrading and related marine services for its fleet of 137 ships. Teekay Marine Services is a subsidiary of Teekay Corporation, an international leader in energy shipping which serves the world’s leading oil and gas companies.

Sembawang Shipyard, a wholly-owned subsidiary of Sembcorp Marine has signed a long-term alliance contract with Teekay Marine Services, Canada, to provide ship-repair, refurbishment, upgrading and related marine services for its fleet of 137 ships. Teekay Marine Services is a subsidiary of Teekay Corporation, an international leader in energy shipping which serves the world’s leading oil and gas companies.This long-term maintenance and refit alliance contract signed in Vancouver, by Captain Graham Westgarth, President of Teekay Marine Services and Ms. Wong Lee Lin, Executive Director of Sembawang Shipyard, commits to offer the repairs, refurbishment and upgrading of Teekay’s fleet of vessels docking in Singapore to Sembawang Shipyard. It also supports joint planning, information and experience sharing, thus leveraging complementary resources to achieve sustainable targets in the areas of HSSE (Health, Safety, Security and Environment), quality, cost-efficiency and timely deliveries. This partnership will lead to process-based improvements in refits and ship maintenance using best practices of both companies.

Captain Graham Westgarth, President of Teekay Marine Services said, “This ship-repair alliance is between two companies which are keen on having continuous improvement in their organisations thus enhancing their competitiveness. The alliance will benefit both organisations as we will maximize our ships’ trading days through safe repairs, better planning, quality enhancement and maximization of resources utilization. Through such processes, we will be able to carry out our dry dockings and upgrades in a safe, efficient and cost-effective way. The selection of Sembawang Shipyard as our exclusive alliance partner in Singapore is in line with Teekay’s global refit strategy to work towards achieving such continuous improvement in repair processes and implementing best practices across Teekay’s entire fleet. Sembawang Shipyard is internationally recognised for its safety track record and as one of the most technically competent and efficient repair yards in the world. We have had many positive experiences with Sembawang Shipyard, which laid the foundation for us to enter into this long-term partnership arrangement with the Shipyard. More than these, the alliance is about trust and commitment between our two companies. We thus look forward to a long and successful partnership with Sembawang Shipyard.”

Ms. Wong Lee Lin, Executive Director of Sembawang Shipyard said “Teekay is a world leader in global shipping and we are indeed pleased to be Teekay’s chosen partner. The Teekay-Sembawang Shipyard alliance is the result of a close collaborative relationship between two like-minded organisations with the intent of accomplishing mutually compatible goals. This innovative alliance enables synergistic value creation resulting from the co-sharing of knowledge, skills and experiences on the technical repairs, the operation of the ships and systems improvements. Sembawang Shipyard has a good track record in delivering alliance benefits to our partners. Our alliance structure and processes will bring about continuous improvements in the way Teekay ships are being repaired and upgraded. We look forward to a long-term partnership which will deliver visible mutual benefits to both companies, especially in the areas of HSSE, quality, planning and cost efficiency.”

With the signing of this long-term contract, Sembawang Shipyard can anticipate the refit and/or upgrade of 6 to 8 Teekay vessels each year. In February 2011, Sembawang Shipyard repaired Teekay’s shuttle tanker, Navion Savonita, which is operated by Teekay Brazil. There are three other vessels scheduled for repairs in Sembawang Shipyard in the first half of 2011.

The above contract is not expected to have any material impact on the consolidated net tangible assets per share and earnings per share of Sembcorp Marine for the year ending December 31, 2011.

About Teekay Corporation

Teekay Marine Services is a subsidiary of Teekay Corporation, a recognized international leader in energy shipping and responsible for approximately 10 percent of the world’s seaborne oil transportation. Teekay Corporation has built a significant presence in the liquefied natural gas shipping sector through its publicly-listed subsidiary, Teekay LNG Partners L.P., is further growing its operations in the offshore oil production, storage and transportation sector through its publicly-listed subsidiary, Teekay Offshore Partners L.P., and continues to expand its conventional tanker business through its publicly-listed subsidiary, Teekay Tankers Ltd.

Operationally headquartered in Vancouver, Teekay Corporation has offices in 16 countries and over 6,100 seagoing and shore-based employees. Its ship management services – currently for a fleet of over 148 vessels – reflect the industry’s highest operations and vessel maintenance standards – in technical support, marine human resources, and a range of specialized services. A global network of Teekay experts supports all these services. Teekay’s reputation for safety, quality and innovation has earned it a position with its customers as The Marine Midstream Company.

About Sembawang Shipyard

Sembawang Shipyard, a wholly-owned subsidiary of Sembcorp Marine, has one of the largest integrated ship repair facilities in Southeast Asia. The shipyard’s world-class reputation is based on the company’s commitment to high quality standards, Health, Safety and Environment standards, timely delivery, superior customer service and innovative solutions.

Besides its proven expertise in the sectors of tankers, bulk carriers and container / cargo vessels, the shipyard is also recognised as a specialist in the niche markets such as passenger ship conversion/upgrading/repairs, LNG carrier repairs, FPSO conversion, offshore conversion and new building, damage repairs and repair of chemical tankers, liquefied gas carriers and navy ships.

Havyard builds vessels for Sartor Offshore

Sartor Offshore has ordered a Norwegian ship design developed from Havyard Ship Technology AS to approx. 300 million. The PSV, which will be built at shipyard in Sogn, is scheduled for delivery in January 2012. “The contract is based on optimism within the industry. Currently, the vessel does not have a contract, however, the energy in the marked is intensifying and we regard the decision to build as forward looking and the right decision” CEO Roy Wareberg in Sartor Offshore says.

The vessel has been developed in Norway, where there already have been built eleven ships of the type Havyard 832 L. Sartor Offshore has also secured an option for an additional vessel with delivery in June 2012. The Havyard 832 L –design has set a new standard for medium-sized supply vessels, as it offers greater cargo capacity and more flexibility, better performance and lower fuel consumption than competitive models. Completed vessels are all awarded long-term contracts, and have received positive feedback from owners and crews.

Sartor Offshore currently has 24 vessels in the portfolio and has begun an extensive renewal program. The company is positioning itself to take an international and leading role as supplier of MRV and PSV, which implies readiness, supply and oil spill response. Sartor Offshore has about 600 employees and has its own operating company in Aberdeen.

“The contract from Sartor Offshore is yet another acknowledgment of the design and functionality of Havyard 832 L. We have succeeded in developing modern, environmentally friendly and competitive vessels that are sought after both shipowners and charterers” Geir Johan Bakke of Havyard says.

Sartor Offshore already notice that there is greater optimism and activity both onshore and offshore than last year. The initiated renewal program makes the Sartor fleet more attractive customers. The company already has long-term contracts today with clients such as Statoil, Total, GDF Suez and Shell. The new vessels also hold the highest safety class. “We want to increase our presence through PSVs” Wareberg explains. He is pleased that the Norwegian shipyards again are competitive in quality and price. Financing is arranged by Pareto.

Source: Havyard

Severnaya Shipyard launches PSV for Norwegian customer

OJSC Shipbuilding plant "Severnaya Verf" has launched the offshore platform supply vessel (project VS 485 PSV) for the Norwegian company Solvik Hull Supplies II AS (part of the Solvik Offshore Group), the PortNews correspondent reports from the official launching ceremony held in St. Petersburg.

OJSC Shipbuilding plant "Severnaya Verf" has launched the offshore platform supply vessel (project VS 485 PSV) for the Norwegian company Solvik Hull Supplies II AS (part of the Solvik Offshore Group), the PortNews correspondent reports from the official launching ceremony held in St. Petersburg.The vessel is scheduled for delivery in August - September 2011. The PSV is intended for transportation of mud, methanol, and general cargoes on the open deck, as well as to participate in rescue and fire fighting operations on oil platforms in the North Atlantic. The designer of the vessel is Vik-Sandvik AS (Norway). Classification society - DNV. Flag of Norway. The ship's dimensions: LOA - 85 m, draft - 7 m, DWT – 5,000, cruising speed - 16 knots.

According to Severnaya Shipyard General Director Andrey Fomichev, the approximate cost of the vessel will be around EUR 40 million. This is the second ship built at the shipyard for the Norwegian company. The shipbuilder has bagged a contract for construction of the third vessel. The company has been in talks for building the fourth ship of the series.

The head of the company also noted that "Severnaya Verf" specializes in building all range of vessels to service oil platforms in Norway.

From 2004 St. Petersburg-based OJSC Shipbuilding plant Severnaya Verf (Northern Shipyard) has been part of United Industrial Corporation (Moscow). The main range of products manufactured by the plant includes warships and commercial vessels for various purposes.

Source: Port News

Subscribe to:

Comments (Atom)